As Martin Lewis, the Money Saving Expert has stated:

“Lasting powers of Attorney – they are incredibly important

and arguably more important than a Will”

Ok, so what are lasting powers of attorney (LPAs) and why are they so important?

Lasting Powers of Attorney are legal documents that allow you to appoint one or more people to make decisions on your behalf if you lose mental capacity through injury or illness during your lifetime.

The people you appoint to manage your affairs are called attorneys.

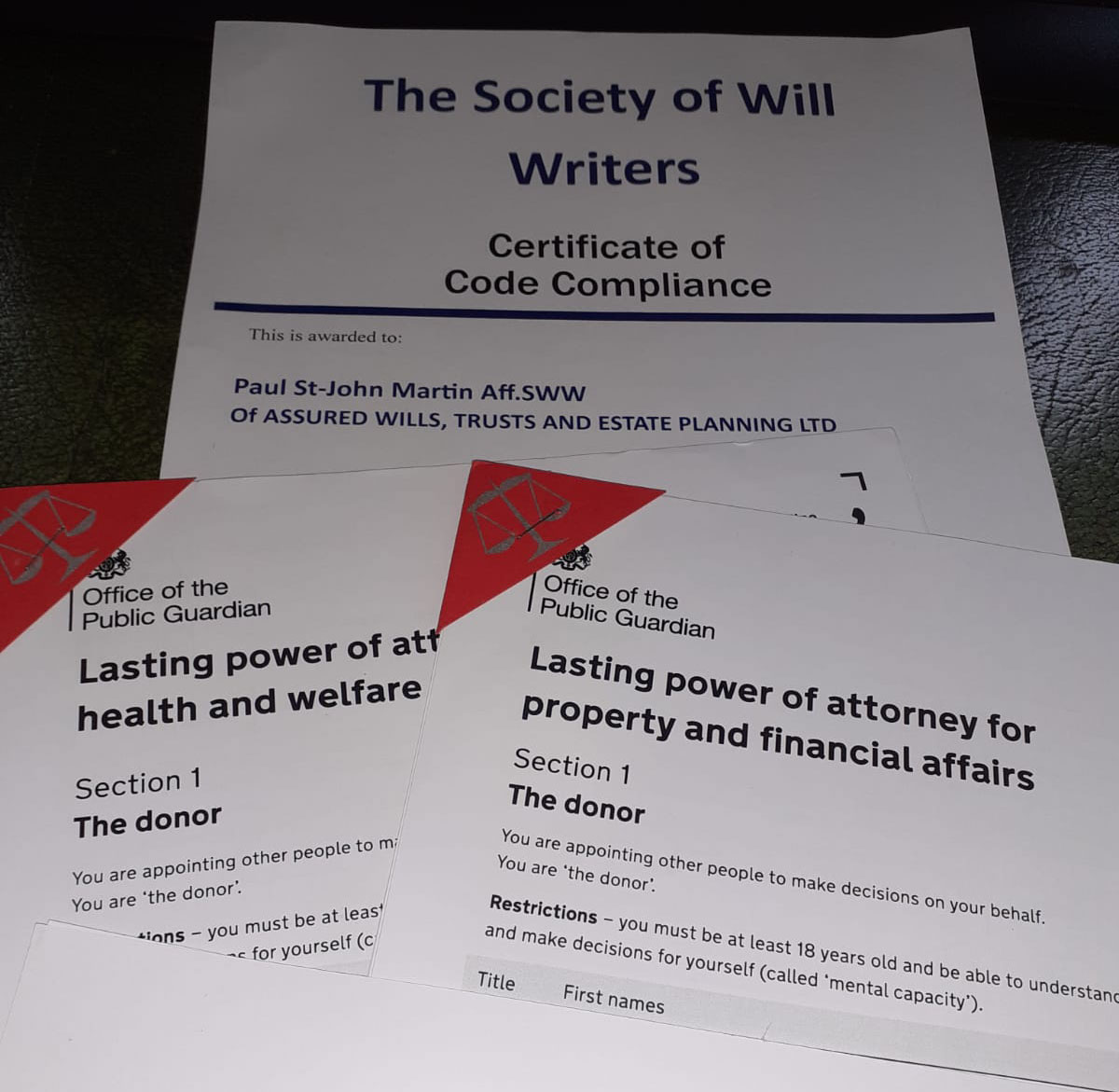

There are two separate types of LPA. One is for health and welfare, and the other is for property and financial affairs. It is key that both are considered to fully protect you.

If you lose capacity without them your loved ones will need to go to court to get permission to look after you. Your bank accounts (including joint ones) are frozen whilst this process is going on.

An LPA is a completely separate legal document to your Will.

If you do not have them in place and then need help the Office of the Public Guardian (OPG) will be called upon to appoint a deputy to make decisions on your behalf. The OPG has estimated the cost of having a Court of Protection Deputy appointed is at least twelve times as much as an LPA. There are also ongoing supervision costs and it may well not be in your family’s best interest.